Getting your products on the shelf is one thing, but getting them off the shelf again is another one of those things that keeps sales managers up at night. When your products stand still on the shelf, they’re not turning into revenue for your retail partners or, perhaps more importantly, allowing you to place additional orders at that store.

As with any industry, certain factors are outside of your control (i.e. market trends, the competition, etc.). However, to remedy your problem, you’ll have to think about those things you do have power over.

You might think of some sales guru or industry giant as having the solution to your dilemma, but consider instead the wisdom of the famed Greek philosopher, Socrates.

Confused? Bear with me.

Taking inspiration from one of man’s greatest minds, you can build a line of defense against one of the biggest offenders of the bottom line, low through-sales. Let’s explore how Socrates recommends beefing up in-store execution.

Nurture Relationships With Retailers

“Be slow to fall into friendship; but when thou art in, continue firm and constant.”

“Be selective about which retailers you partner with, and foster mutually-beneficial relationships with them.”

You might not think of relationships with retailers as being friendships, per say, but you know full-well the value of a mutually beneficial partnership. Relationship-building doesn’t always happen overnight; it can take several interactions with a store man2ager before they grant you a secondary placement, agree to use your POS materials, or come to an agreement on price.

It’s important to position yourself as a consultant to the retailer - your brand needs to add value in a unique way for the relationship to continue. If you don’t, another disrupter might snag your shelf space.

It’s no secret that different retailers have different ways of doing business. To fight against a sales slump, your brand needs a strategic approach to forming and nurturing these indispensable relationships.

Have a Plan of Action

A good starting point is to identify the types of retailers your brand works with, as well as who from your company is in contact with them. That is to say, a field marketing rep probably interacts differently with a C-Store manager than a brand ambassador does with a grocery store owner.

Next, outline how your field team can communicate your brand’s value to retailers. Below are some suggestions for the types of information to present them with:

- Merchandising techniques that are tailored to different retailer types

- Your brand’s current distribution

- Proof of ability to support increased demand for your product

- Historical sales data, broken down by location, retailer type, promotions, time period, or any combination of these factors

- An understanding of current market trends, ideally through primary and secondary research

- Consumer demand for your brand demonstrated through social media buzz

Finally, coach your people. Developing a playbook for how to address the various retailers that they’ll come in contact with can empower field teams to maintain the most lucrative relationships possible.

Expand Visibility With Secondary Placements

“The greatest way to live with honor in this world is to be what we pretend to be.”

“Show your brand’s versatility by landing placements in multiple categories.”

This one asks that we read between the lines a little. You certainly don’t want your brand to be perceived as phony, however, you also don’t want to confine its sales potential to a single category.

That being said, think outside the box about where else in the store consumers might be tempted to purchase your products. For example, you might think that your gourmet thai chili sauce belongs in the condiment aisle, but perhaps it would get better traction nearby the butcher counter.

Researching how and why buyers make impulse purchases puts you in a position to leverage these inclinations and make better decisions about secondary product placements. Curious to learn more? Read all about the psychology behind impulse buys here.

Get Inside Consumers’ Heads

There’s a lot of research out there about shopping patterns and what motivates consumers to buy. Food and beverage brands should think about the following action items:

- Price point - Check out this post for specific pricing strategies your brand can start using ASAP. Here’s some key takeaways:

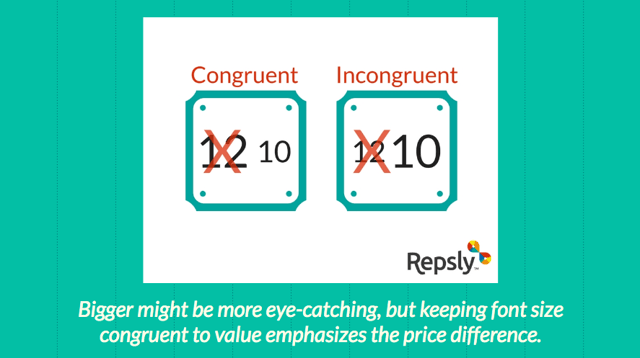

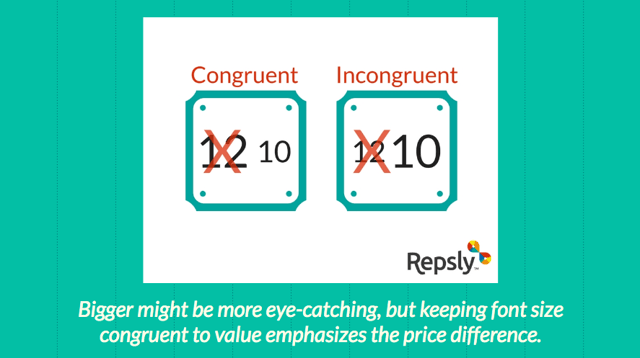

Displaying sale prices in a font larger than that of the list price can actually have an adverse effect.

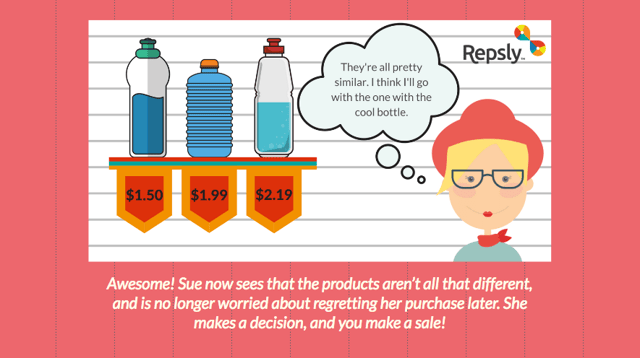

Slight price differences between substitutional products increases the likelihood that consumers will make a purchase.

Using “9s” makes a product seem whole dollars cheaper, and more attractive to buy.

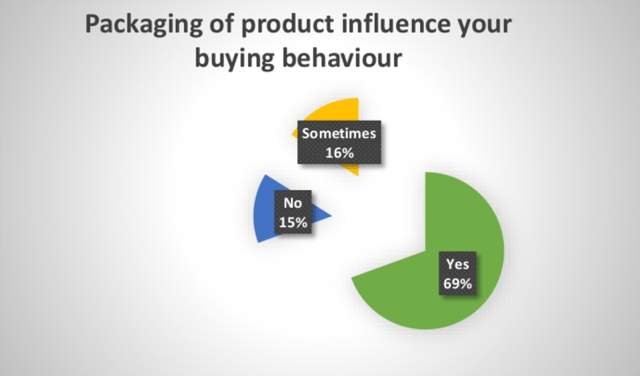

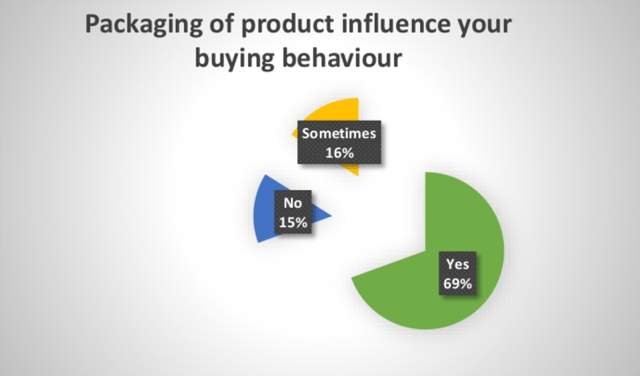

- Packaging - One study found that 69% of shoppers report product packaging as being an influential factor in their purchasing decision. A study on the impact of product packaging on purchasing behavior found that elements such as color, wrapper design, and packaging innovation have a strong effect on a consumer’s likelihood to buy.

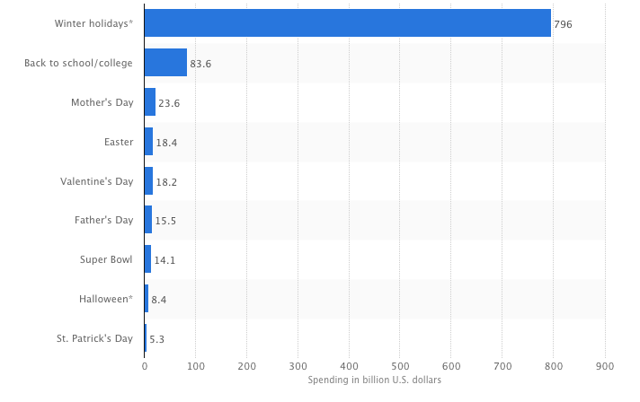

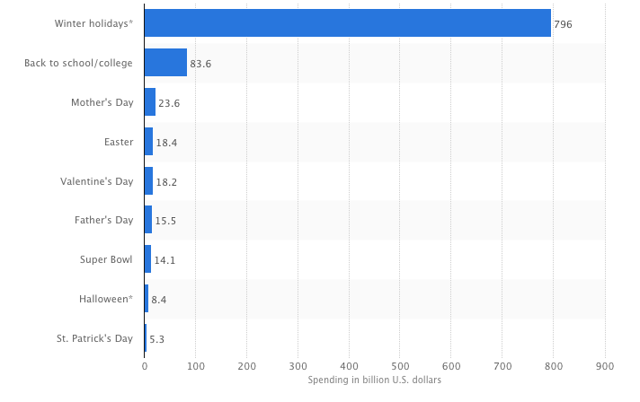

- Seasonality - Sure, winter holiday spending is astronomical compared to the rest of the year. But take a look at these other holidays that drive retail sales. The chart below shows the total expected consumer spending by seasonal event in billions of dollars.

- Signage - One study found that POP displays with accompanying signage outperforms similar displays without signs by 20%! Similarly, full-price merchandise has been shown to outsell sale or clearance items by 18% when signage is present nearby. Check out the Pinterest board below for some creative POP display ideas.

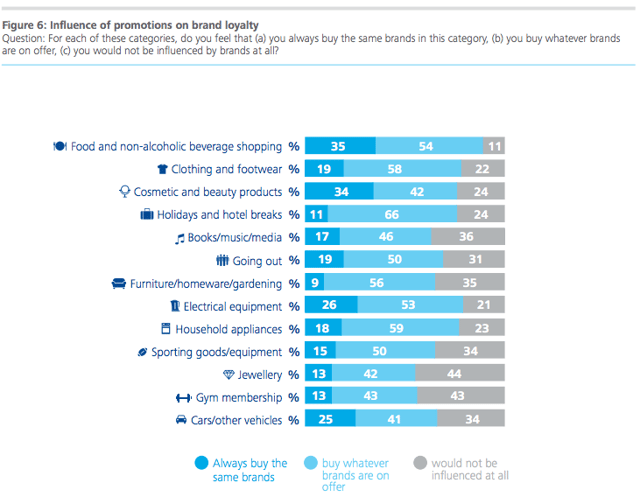

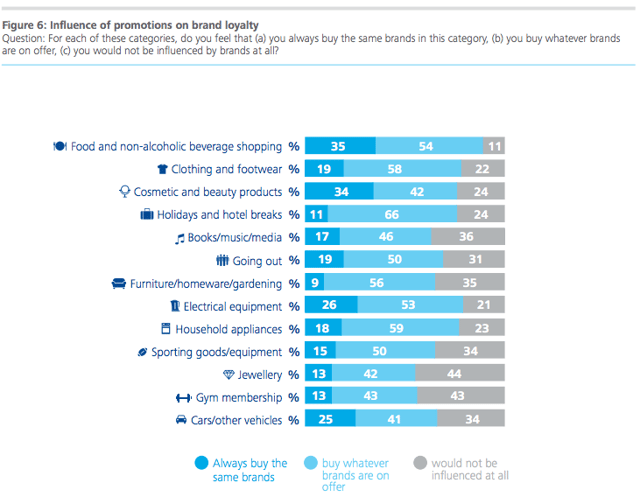

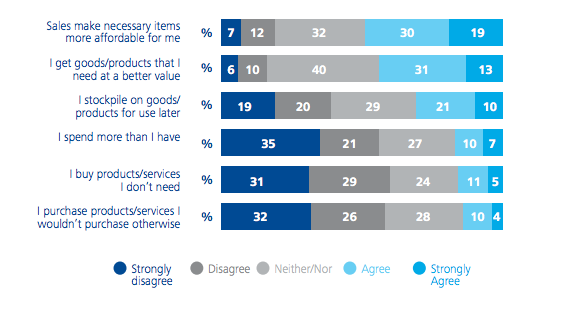

- Promotions - Discounts and deals can have a huge impact on consumers’ spending habits. Research from Deloitte Ireland found that 54% of shoppers buy from brands that are on sale in the food and non-alcoholic beverage category, compared to 35% who remain loyal to brands they’ve bought from in the past regardless of a promotion.

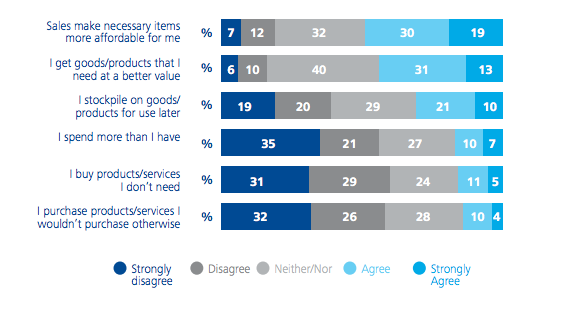

Similarly, some shoppers report buying more than they would have as a result of promotions.

Other studies have shown that 74% of consumers made an impulse purchase as a result of a product sampling event.

- Category placement - As a general rule of thumb, products located near the checkout counter or near your brand’s best sellers tend to drive impulse buys. Placing complementary items near each other has been shown to have the same effect. Consider the example of wine and cheese or crackers and jam.

Prevent Out-of-Stocks to Keep Your Bottom Line Healthy

“Beware the barrenness of a busy life.”

“Don’t be so consumed by other business activities that you forget about shelf velocity.”

Socrates might have been ahead of his time here. Too often we get caught up in life’s craziness that we neglect what is most important. In the case of a food and beverage brand, that is the ability to move product off the shelf.

It can be tempting to focus a disproportionate amount of time and energy on brand building and other business activities, and not enough on store-level success. Establishing a process for preventing stockouts is a critical first step to keeping sales afloat.

Prioritize The Process

Your brand needs a way to intercept stockouts proactively instead of dealing with them reactively. Standardizing how reps catch out-of-stocks is critical for consistency across accounts.

A rule of thumb - keep it simple, and keep it actionable. Here’s a sample process for OOS prevention we created to help your brand keep the facings it worked hard to get, using the acronym MAAR; Follow this link to learn about it in more detail.

- Measure: Stay ahead of the curve by collecting data that lends itself to predicting when a SKU will sell out, rather than how many holes are present on the shelf. Audit inventory levels, planogram compliance, and the number of units ordered over time. Also collect data on promotions, seasonality, and the economic climate when possible, as these all have an effect on OOS rates.

- Analyze: Take a deep dive into the data you’ve gathered to improve your demand forecasting. You’ll probably notice patterns related to time of year, geography, or pricing.

- Adjust: Identify which SKUs are in high demand on a temporary and permanent basis so that manufacturers can keep up with demand. Alter delivery schedules to ensure products are on the shelf when they need to be there.

- Repeat: The insights you find the first time around unfortunately aren’t evergreen. As the market ebbs and flows, you’ll need to repeat this process regularly.

Shoot For Shelf Presence That Maintains Your Brand’s Integrity

“Be as you wish to seem.”

“Show off your brand’s personality on the shelf level.”

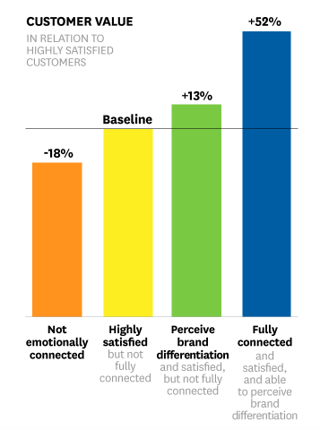

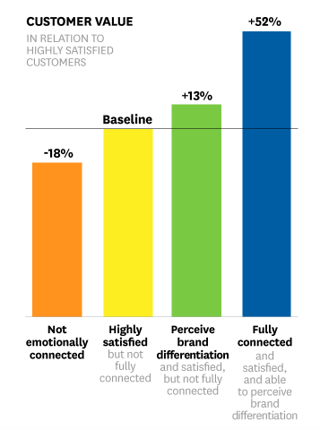

You know that customers often buy because they believe in a brand’s mission and values. In fact, Harvard-backed research shows that consumers who feel a “full” emotional connection to a brand are 52% more valuable to the company than consumers who identify as being “highly satisfied.”

What’s more, researchers found that fully connected customers spend twice as much annually as highly satisfied customers. Protect your brand’s integrity by merchandising products in a way that represents its personality.

Remember What Matters: Packaging, Placement, Price

You have three opportunities on the shelf to influence consumers’ purchasing decisions - namely, product packaging, shelf placement, and unit price.

Packaging

Does your brand pledge to sustainability? Then using recycled materials would make sense. Are you big on transparency? If so, clear packaging allows customers to see exactly what they’re getting. Do a portion of your profits support a charitable organization? Make this known somewhere on your label. The more you can tell consumers about your brand via packaging, the better.

Placement

There’s some room to think creatively here. For example, if you sell an ultra-nutritious product, try putting it next to something unhealthy to highlight the contrast between your brand and the other guy. Also be sure to make your products available where consumers expect to find them (although secondary placements in diverse categories is definitely encouraged).

Price

As the saying goes, you get what you pay for. Higher-quality items demand a higher price tag. The opposite is true for items made of cheaper ingredients. Also be thinking about consumers’ need for your product. Do you offer something niche that users are willing to pay a premium for? Or are you competing in a crowded space for a commodity item? Since price accounts for a huge portion of the buying process, staying in tune with spending trends is crucial.

Check out this interactive image to see these concepts in action on a real shelf.

Become King of The Category Through Upsells

“Let him that would move the world first move himself.”

“More facings on the shelf leads to more sales.”

The last piece of advice from our voice of inspiration implies that you can’t dominate your category without first increasing your market share. Simply having more facings increases the likelihood that consumers will choose your brand over another. Upsells are a key component of the cure to your low through-sales.

Research Your Options

Unfortunately there’s no silver bullet for boosting upsells overnight. The best strategy involves taking the time to research winning techniques that other successful brands have gained traction with. Surveying veteran brands or taking notes of in-store observations are two good starting points for improving your own brand’s upselling efforts.

Next Steps

It’s rare that products fly off the shelf without any push from the brands that produce them. We got a little philosophical, but you still have plenty of practical action items that your brand can start running with today.

.png?width=480&height=252&name=PRESS%20RELEASE-2%20(4).png)