We talk a lot about Data-Driven Retail Execution at Repsly. We talk with each other, with our customers, with analysts, partners, and even with our competitors. What is most interesting to me is that the more people I talk with, the more I understand how many ways there are for data to impact the effectiveness, and resulting ROI of In-Store Retail Execution. Effective data analysis can have significant impacts across all parts of an organization, not just its Retail Execution teams. The problem is that only about 40 percent of CPG companies are getting positive returns from the investments they make in data analytics solutions1.

We’re hearing more and more about data overload, without clear pathways to creating impact at scale, however, we have also seen the incredible impact that successfully using data can have on the top and bottom lines of CPGs that compete in the trade. In this post, I’ll explore some of the success stories we’ve seen that provide dramatic results, and how data can be leveraged to create these wins.

The Premise:

Our understanding of how data can impact Retail Execution has been evolving for years, from the earliest use cases our customers implemented in order to gain visibility into ‘the last kilometer’ of their product distribution, to the amalgamation of Trade Planning, Point of Sale, and Inventory data we’ve implemented this year. What we’ve seen over and over again is that the more that is known about what is happening to a product on its journey from the manufacturer (factory or bakery, or farm, or plant) to the consumer, the better a company can be at predicting when, where, and what kind of human intervention is required in order to facilitate the ultimate goal of a successful sale at the shelf.

For example, if your systems are telling you that a full pallet of product was delivered to a store the day before a promotion started, and the POS data is telling you that there was a dramatic drop in sales on day two of the promo, you can be fairly certain that the product was not packed out. Sending one of your territory reps to that store as soon as possible will certainly be more valuable than having them pay a visit to a store that is reporting the expected promotional lift.

I’ll explore several examples similar to this of how combinations of data can help you drive up your returns at retail while driving down your field-related expenses.

The Basics:

In the early days of Repsly’s foray into Retail Execution (circa 2008), there were two overwhelming use cases that our customers were interested in solving: driving accountability of their field teams and capturing useful data about product conditions on the shelf. If the data could show our customers that Joe was actually visiting the number of outlets they expected, and if they could understand where there were distribution issues, non-standard pricing, and presentations that did not meet brand guidelines, they felt empowered and in control. We could deliver this with simple GPS check-in and basic data collection forms.

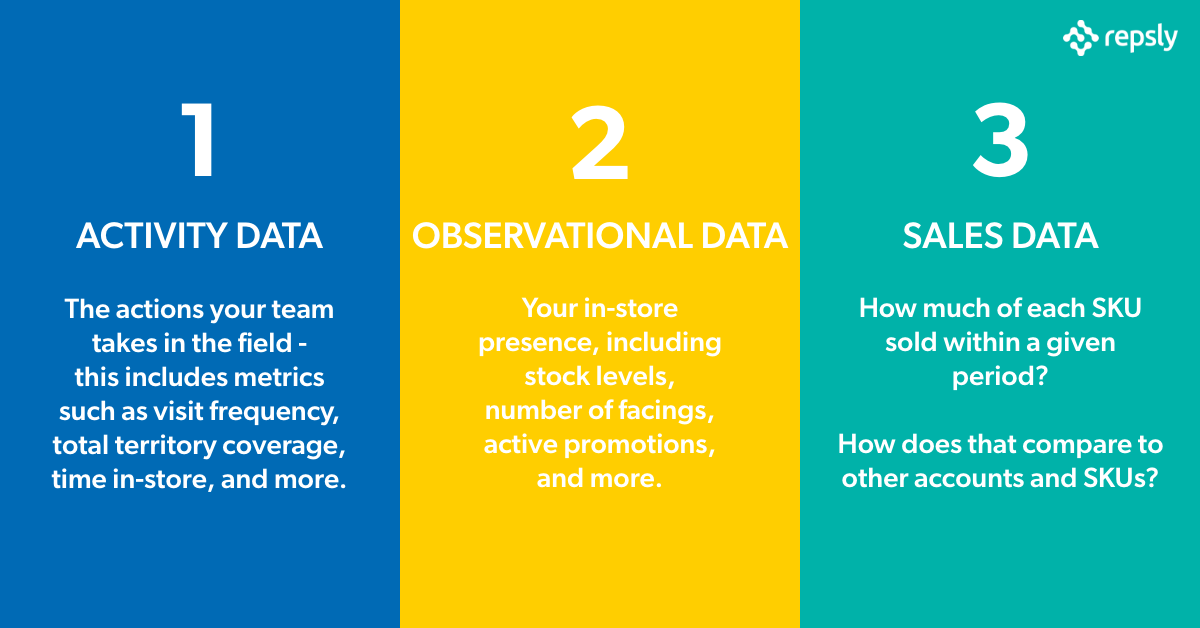

Over the years, and literally thousands of implementations of our platform for CPG field teams, we have seen the evolution of the data-driven value that CPG brands create around retail execution to now coming from the combination of several core types of data, some generated within the Retail Execution platform (Activity and Observations) and others delivered through sharing between systems:

- Activity Data, which informs what the reps in the field are actually doing. Which activities, at which outlets, on what frequency, and with what level of success.

- Observed data, or what the reps see when they are in the trade. Things like the condition of the product on the shelf (Price, availability, promotion status…), competitor proximity presence and activity, Planogram compliance, store demographics… the opportunities are unlimited.

- Sales data, ideally by SKU, by Store, by Day; both current & historical. This is a big ask in some environments, but the value this level of granularity and data freshness provides is extremely valuable when combined with the other factors!

- Promotion Planning and related Demand Planning Data. Knowing what is going to be promoted when and where, as well as the lift those promotions are expected to drive enables you to analyze surrounding factors that can be controlled to drive maximum performance and return from those promotions.

- Supply Chain Data including in-store inventory levels, shipment and depletion data, backorders, and warehouse lead times.

- Data about Consumer Behavior trends. The evolution of social media analytics is making it possible to identify emerging shifts in consumer behavior in near real-time, enabling brands to meet those shifts as they are happening instead of after the opportunity has peaked.

There are certainly more types of data and segments within these that are important to driving the performance of Retail Execution, but these make up the backbone of powerful data that can drive incredibly impactful results.

Success Stories:

I’ve had the great fortune of working with a wide variety of CPG brands as well as retailers over the course of my career, selling In-Store Processors and POS Systems to grocery chains in the 1990s, to implementing extremely large scale Retail Execution solutions for Global CPGs like Coca-Cola, P&G, and Pepperidge Farm. Over the past 10 years at Repsly I’ve seen more than 1,000 implementations of our Retail Execution platform, and I continue to be impressed by both how varied ‘routes to market’ are, and by how innovative brands can be in how they determine where and how much to invest in ‘hands-on’ merchandising.

I’ve seen a lot of emerging brands enthusiastically react to how much impact effective in-store merchandising can have, and I’ve seen large CPGs make incredible swings in the success of product launches, promotions, and category dominance by focusing on A.G. Lafley’s “First Moment of Truth”2: when the consumer is standing in front of the shelf and decides which product to buy.

Here are three highly impactful scenarios that I’ve seen that evidence just how much value a CPG brand can get if it effectively combines two or more of the core data types discussed above.

Trade Promotion Optimization

One of the Key Performance Indicators(KPIs) that our customers work hard to impact is Promotion Compliance. Our customers have told us that they suspect 30-50 percent of their in-store promotional activity is not executed to plan, driving down the overall effectiveness of the promotion. We’ve seen innumerable examples of the problems that occur when a promotion is supposed to be in place, from improper pricing to empty or missing displays to displays full of a competitor’s product!

Most CPG Field Teams cover their highest volume stores on a regular schedule but may shift to ‘doubling down’ on a particular banner when there is a promotion running. The problem is that even with an elevated schedule of visits, the team is relying on ‘stumbling across’ a problem. Every day that a promotion is not performing in a single store means lost sales, and a significant percentage of stores may never have the promotion executed properly. The high-impact solution to this problem that we’ve seen CPGs implement is to combine Trade Promotion Planning data with daily POS data, and directing reps only to the stores where there is a problem.

For example, you may be running a promotion in a 450 door grocery chain that your reps cover once every 2 weeks. On average, they would come across a problem halfway through a 2-week promotion, and would completely miss half of the 1-week runs. If you combine the data that I just mentioned (TPM and POS) you will see which stores are achieving your expected lift on the first day of the promotion and more importantly which ones are not. These are the stores that your reps should visit ASAP! Being able to identify and correct issues with in-store compliance will significantly drive up overall promotion performance, and give you a much higher ROI on your field team.

Plumping Shelves

Studies have shown that ingestible products like beverages and snacks perform better when they are presented on full shelves. Consumers have an aversion to selecting these products from a largely empty and disorganized shelf3 when a comparable competitor’s placement is luxuriously full; they don’t want to buy the ‘leftovers’ that other people have handled and pushed around. Retailers are extremely busy, and may not prioritize filling your shelf whenever a shipment is delivered. You may be suffering the pain of understocked shelves even if your product is in ample supply in the back room. The best way to combat this is to inform your scheduling process (aka Coverage Plans) with shipment data.

If you know that a pallet of product has shipped to a store, scheduling a rep to follow that delivery and ensure that as much of that shipment is packed out as possible will drive an increase in velocity, as well as an increase in the value of the visit. The conversely related use case combines TPM data with shipment data, letting you know if a shipment has not been made in time to accommodate the demand expected from a promotion that is starting can enable you to avoid the worst kind of out of stock (during an expensive promotion) by having your reps take proactive measures like shifting inventory between stores.

Activity Optimization

Near real-time POS data is, in many cases, difficult to obtain or out of budget to acquire and implement into daily processes. If your systems and processes enable you to work with historic views of data, you can still leverage the power of data to determine how to optimize your field team’s activities. You can score the relative value of what a rep does by analyzing the correlation between certain activities and sales trends over time. This kind of analysis is made more powerful by including A/B testing. For example, if you only have aggregated monthly sales data by region, you can change the behavior of one region’s reps (e.g.; increase the visit frequency in one region for a month) to determine what impact that change has on overall sales. We have seen customers vary several aspects of the desired behaviors to determine how to structure the perfect store visit for their particular go to market, including the number of visits vs. visit length, time spent with managers, frequency of training activities (for training in-store personnel), interactions with consumers. The definition of a perfect visit can vary greatly with the channel, store demographic, product category, time of year among other things. Continuously measuring and analyzing what kind of behaviors have the highest impact on sales enable you to construct the version that best suits your product and go-to-market.

There are dozens of additional use cases for leveraging data to drive the performance of Retail Execution field teams, and the topic of data runs extremely deep. I’ll be sharing more thoughts and experiences on how consumer goods companies can leverage data to drive more sales, including some work we’ve been doing around “data maturity” and how it relates to the stage of growth, and some best practices for creating and delivering a successful data strategy in your business.

Interested in reading additional insights from industry leaders? Subscribe to our blog to never miss an update from Repsly, CEO Matthew Brogie, as well as receive additional updates and information about the Repsly product directly in your inbox.

.png?width=770&height=404&name=ENDCAPS%20AND%20INSIGHTS%20(1).png)

.png?width=480&height=252&name=PRESS%20RELEASE-2%20(4).png)