The retail industry is plagued by poor in-store execution, among a host of other external threats. IRI reports that out-of-stocks alone cost retailers $47.4 billion annually, in addition to the cost of safety stock. What’s more, research shows that only about 39% of consumer goods brands are satisfied with their store-level execution.

Figures like these make the case for a new approach to retail execution, one that’s designed to overcome the challenges of today’s market landscape.

For decades, consumer packaged goods companies have accepted delays in information as the status quo, a phenomenon that poses a serious threat to in-store sales performance. To stay close to their retail accounts and ahead of their competitors, savvy CPGs are adopting a cyclical execution framework that centralizes their most integral data sources into a single system.

The Virtuous Cycle

CPGs historically have employed a reactive retail execution strategy that’s rigid in its ability to effect change at brick-and-mortar. Although this structure might have worked well in the past, it’s outdated in the information age where brands have more immediate access to data about store-level conditions.

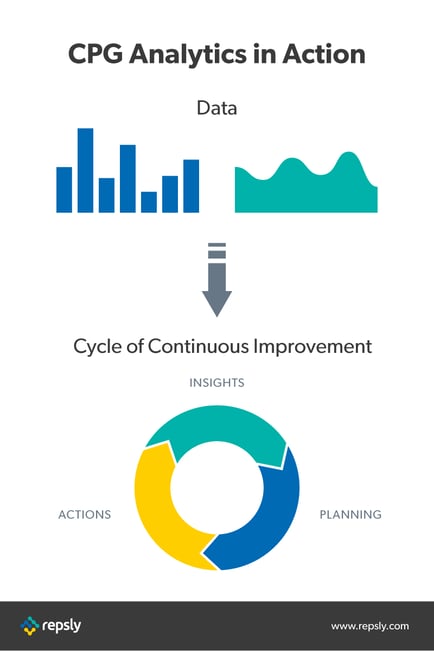

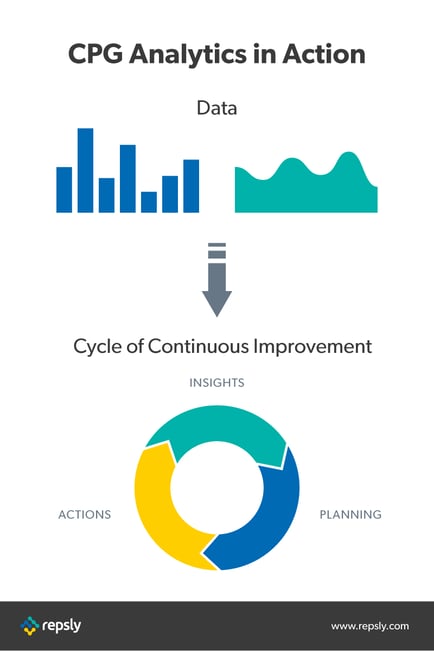

Instead, today’s top CPGs are utilizing a proactive strategy that’s rooted in a cycle of continuous improvement. This schema is essentially a virtuous cycle of insights, planning, and action.

Let’s break it down:

- Insights: Insights are drawn using analytics tools that amass the data CPGs collect in the retail environment.

- Planning: CPGs then use this data to adjust their strategy more rapidly, enabling them to correct compliance issues, react to competitive activity, and replenish stockout faster than ever before.

- Action: Finally, the changes are deployed at retail and the cycle repeats itself.

Real-World Application

To better understand the practical application of this cycle, consider the following example:

A brand representative for a bottled beverage company visits a convenience store, where she performs a routine audit — only to find that one of her company’s top-selling SKUs has lost its facing on the shelf. She notes this disappearance in her audit, and confirms that the facing must have been taken away a few days prior after taking a look at the store’s sales data and seeing a sudden drop in sales for that particular SKU.

The audit is received in real-time by her manager, who sees a pattern of a missing SKU at this specific c-store chain as reported by other reps in the same territory. The manager decides to correct this issue by scheduling follow-up visits within the week for all reps assigned to the account so they can investigate further.

This scenario is advantageous for a number of reasons. First, the rep in the field is able to do her job better by having access to sales data on the fly. This additional data source arms her with the intel she needs to best assess the situation.

Second, there is no lag in the exchange of information between the rep and her manager. Therefore, the manager is able to detect concerns within minutes instead of days based on the data he’s viewing. Finally, the manager implements a solution to the problem at hand to get it taken care of ASAP.

Data Centralization

This major process improvement is possible because CPGs today can access and report on multiple data points from a single platform, thus allowing for greater agility in execution. This contrasts with systems past, in which brands didn’t have fast or easy access to vital retail data and, therefore, were forced to make changes at a much slower pace.

Some of the data points that CPGs are now combining to inform their retail execution programs include:

- Syndicated sales data

- Frequency of visits to a given account

- Time spent in-store by field reps

- Travel time between account visits

- Number of facings on the shelf

- Promotional compliance

- Stock levels

- Competitor activity.

As much as 25% of sales are lost to poor retail execution practices, according to Quri. CPGs can’t afford to take this hit and risk being knocked off the shelf by a competitor. They’re combating this threat by taking a data-driven approach that’s rooted in continuous improvement.

.png?width=480&height=252&name=PRESS%20RELEASE-2%20(4).png)